It’s 2025, and the idea of waiting a full year to find out whether your internal controls are working is as outdated as fax machines in the finance department. Businesses move in real time, with transactions, risks, and decisions happening every second, yet traditional audits still operate like they’re frozen in time.

That’s changing fast. Continuous assurance is taking center stage, shifting organizations away from reactive, annual audits toward proactive, real-time risk monitoring. For modern enterprises operating in hybrid IT and cloud ecosystems, this evolution isn’t optional; it’s survival.

In this blog, we’ll unpack why the annual audit model is dying, how continuous assurance works, and what IT and cybersecurity leaders can do to make their organizations audit-ready every day of the year.

The traditional audit cycle was designed for a slower world where transactions were batch-processed, systems were on-premise, and change was incremental. Today’s reality couldn’t be more different:

By the time auditors test a control at year-end, the environment they’re assessing has already changed dozens of times. The result:

In essence, annual audits are rearview mirrors in a world that demands live dashboards.

Continuous assurance is the evolution of audit and compliance into a real-time, technology-enabled process.

Instead of manual evidence collection once a year, it uses automation, analytics, and continuous controls monitoring (CCM) to validate control effectiveness 24/7.

The concept is simple but transformative:

“If transactions happen continuously, assurance should too.”

Instead of a single annual audit event, continuous assurance creates a permanent audit layer woven into business processes.

.png)

A traditional audit asks, “Did this control work last quarter?”

Continuous assurance asks, “Is this control working right now?”

This is more than semantics; it’s a fundamental change in governance philosophy.

In a continuous model, auditors transition from periodic testers to real-time advisors. Risk and compliance teams move from manual data gathering to strategic oversight, focusing on exceptions and trend analysis rather than chasing evidence.

This shift mirrors how cybersecurity evolved from annual penetration tests to continuous threat detection. Governance, risk, and compliance (GRC) is following the same path.

Implementing continuous assurance requires rethinking people, processes, and technology. Here’s how it typically functions in a mature organization:

Controls data is pulled automatically from systems like:

This eliminates manual extraction and ensures auditors see live, system-of-record data.

CCM tools automatically test control effectiveness against defined rules. For example:

When a control exception occurs, such as an unapproved configuration change, the system triggers alerts to control owners and compliance officers. Dashboards visualize control health, risk scores, and trends over time.

Every control test, alert, and remediation action is logged automatically, creating a continuous audit trail. Auditors can review this data directly, drastically reducing evidence requests.

Machine learning analyzes control history to predict potential failures before they occur. For example, it might flag a department with recurring SoD exceptions as a future risk hotspot.

A global consumer goods company faced recurring audit findings in its access management process. Each year, the same issues surfaced delayed deprovisioning, incomplete reviews, and missing evidence.

By implementing a continuous assurance model integrated with its IAM and ERP systems, the company achieved:

When the next audit cycle came around, instead of scrambling for screenshots, auditors simply accessed live dashboards, turning a two-month review into a one-week verification.

Continuous assurance doesn’t just improve compliance; it transforms how organizations manage risk and efficiency.

Evidence is always current, and every control test is timestamped and traceable. No more last-minute evidence hunts.

Automation replaces hundreds of manual hours spent testing controls and gathering documentation.

Executives gain a continuous risk dashboard, showing which controls are healthy and which need attention, enabling proactive remediation.

Regulators increasingly prefer continuous models. They demonstrate ongoing governance maturity and reduce the perception of “point-in-time” compliance.

By using shared dashboards and common data sources, assurance teams and business owners work from the same version of truth.

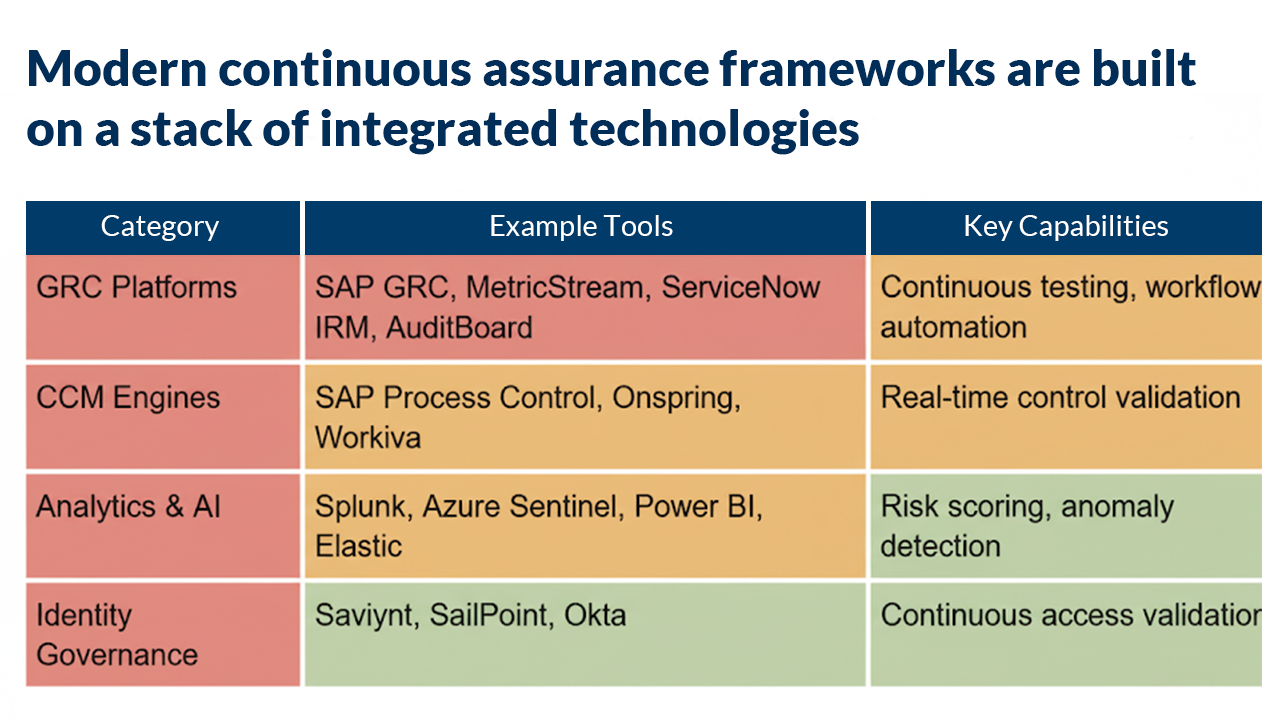

Modern continuous assurance frameworks are built on a stack of integrated technologies:

The secret isn’t just in adopting one tool; it’s in integrating multiple systems into a unified assurance layer.

Even with automation, continuous assurance is not a plug-and-play exercise.

If underlying systems have inconsistent data, automation will replicate those flaws faster.

Fix: Start with data cleansing and enforce governance on master data fields.

People are used to the annual rhythm of audits. Moving to continuous oversight can feel invasive.

Fix: Communicate benefits less manual evidence collection and fewer fire drills.

Different systems generate data in different formats.

Fix: Use middleware or API gateways to normalize and enrich data before feeding it into assurance dashboards.

When controls run automatically, ownership can get ambiguous.

Fix: Clearly define roles for each control owner, approver, and auditor in your governance framework.

AI is reshaping continuous assurance by transforming how organizations detect and respond to control failures.

This evolution means assurance will move from reporting what happened to anticipating what could happen.

The next generation of enterprises will treat assurance like cloud computing always on, always scalable, always adaptive.

Audit cycles will no longer define control validation. Instead, organizations will operate within living assurance ecosystems, where controls are tested, reported, and optimized automatically.

The result? Risk visibility in real time, faster remediation, and governance that evolves as quickly as the business it protects.

At TechRisk Partners (TRPGLOBAL), we help organizations transition from outdated audit cycles to continuous assurance ecosystems. Using our RiskSuccess© framework, we integrate automation, analytics, and governance to deliver 24/7 audit readiness and real-time control visibility.

Ready to retire the annual audit? Contact us to learn how continuous assurance can future-proof your compliance strategy.

In our newsletter, explore an array of projects that exemplify our commitment to excellence, innovation, and successful collaborations across industries.